Learning to do for yourself can have huge payoffs. How many manual skills learned from rolling tortillas, can be put to use in other tasks around the house, saving you money?

I interviewed Whitney Pier resident Brian Dean, and his partner Erin, back in February. Since then, Brian has written a guest piece here about cleaning up your neighbourhood, which was honest, sharp-witted, and funny. He’s a really thrifty guy and he and Erin live by a simple budget that is going to allow them to pay off their mortgage soon. So, I asked him to write a post for the Frugal Friday feature, with his thoughts on thriftiness. Here, he explains his thoughts about how money and community interact, how you can be free of debt, and the best kind of cookware for your buck.

It’s a great read – hold on for the ride!

When I was approached to write a piece on how to stretch one’s dollar, at first I thought, “Great! Finally I can put my natural state of cheapness to profit.” After thinking about it a bit more, though, I came to realize that I’m not just cheap, or even cheap at all — frugality is a science! I simply obey her laws.

More than just a personal means to wealth, this science imparts the opportunity to increase the general wealth of the community around me, and increase one’s astuteness in life in general.

Let me begin with a quick bit on community, because it is PARAMOUNT to our well-being as a social animal. You see, frugality can be practiced in two ways:

1) intelligently

2) foolishly

Increasing personal wealth by simply being greedy most often backfires terribly, like the hand who takes all of the food for itself, and fails to give it to the stomach – for the stomach, the community, feeds our personal wealth in a very indirect, but vitally important, way. I’ll explain how.

But I won’t start this discussion handing out silly, obvious tips like “buy generic”. That way of saving can be sometimes, but not always, filed under the “foolish” way to wealth, because it is contagious to every aspect of our being, leading to us more often than not “starving the stomach” for the short-lived benefit of the hand.

It also creates a general sense of “money paranoia”. Money is not meant to rule our lives. Sadly, for too many of us, it often does just that. Becoming financially free means money losing its grasp over you. And that really is the main concern here, and “why we save”, isn’t it.

Our “new” stove. The clock even works, 45 years after it was built! Things built in the old days were built with pride and with the intention of a long service life – profit from your neighbour “upgrading” to crappy new appliances, and put the savings toward your debts!

First things first: your dollars are little soldiers. Knowing this is your first step to personal wealth. You send your soldiers out, and some of them come back to defend your realm, while others leave for good, going to defend other realms. The net soldiers protecting your realm as opposed to those of others, defines your relative wealth, and this can be extended out to your neighbourhood, your province, your country – this is the basis of the economic flow.

When Erin and I set out to buy our first home in Sydney, we were overwhelmed by the abundance of affordable options. Sydney is a goldmine, and we got our pickaxes out without blinking. We had no other options in other cities, to buy a home on an artist and a librarian’s salary. I build mandolins for a living, and believe me, banks are tough on you for owning your own business. They want records, going three years back, and not just to see your revenue, but how much you brought home after investing in your business as well. This did not make my books look very good in their eyes, despite my having plenty of assets. And so despite my frugal nature and ability to survive on less, compared to other people out there the bank saw me as “broke”. A $60,000 house was at the top of my borrowing range.

Now, I NEEDED to own a home, because I was sick to death of paying rent to others, being limited by a landlord’s willingness to let me customize a space, and because I needed a dedicated and stable workshop for my business. Signing those purchase papers was the greatest day of my life, and I breathed a huge sigh of relief.

While you might shy away from the thought of regular maintenance on a home which you do not know how to perform, or perhaps just don’t want to, know that my “rent” is subject only to fluctuations in the interest rate markets. Your rate is subject to that AND inflation over the years, because you are not locked in to any particular price – the landlord will raise prices to cover his costs and secure a profit at your expense. All which means that while my monthly payment is pretty average (it’s actually pretty low on a $60k mortgage, but for the sake of discussion!), in 30 years it will be RIDICULOUSLY cheap. Laughably so, and that’s IF I haven’t already paid it down, in which case I will only owe a small tax each year. I am LOCKED IN to a price. The prices of renters will only increase with reasonable predictability over time. If the average rent is $2500 in 30 years, a very likely scenario, my payment will still be around $250. That, my friends, should appeal to your frugal inner self. That savings equals a lot of travel, a lot of fun, a lot of vacations, a lot of good wine…

Interestingly, some people seem not even to consider their mortgage or rent as debt sometimes. You ask someone what they owe in debt, they tend to ignore the monthly payments they’ll be required to make, saying “I am not in debt” when what they really mean is “I pay off my credit cards each month.” That is a nice start, but what about the fact that the bank may be carrying $100k, $200k, or $300k worth of your house value that you have not yet paid for? If renting, what about the fact that you’ll perhaps owe $12000 in rent each year for the rest of your life? YOU, my friend, are in debt. And, visibly or invisibly, you are wating a lot of money in interest, perhaps someone else’s interest (not to mention THEIR equity/retirement-fund). Aren’t you sick of working for other people all the time? It’s YOUR life!

Our garden supplies us with endless entertainment – no transportation to get there, no fee to get in, great exercise in the fresh air, and free food!

So a quick glance at your mortgage statement or rent bill will show you how much is actually evaporating from your bank account in waste each month, money you don’t get to spend on doing fun things. Buy a house, then PAY IT DOWN. More money in your pocket means more that you can contribute to your family and your community. And that’s how I see savings. Life isn’t just about me – if it was, I’d live in the middle of the desert, with lots of money and no one to share anything with. But the fact is, we live in a dynamic community which in many ways is a lot like the bloodstream of your body. Money enters and exits our local economies each and every day, and the net balance is known as how much you are thriving or dying. If more is exiting than entering, you’re going to need a transfusion! And that’s not a healthy sign. Money must flow into a community for it to grow, because money is also constantly flowing out.

So how exactly does money grow our community? Must it be brought in from the outside, or can wealth self-create, almost like a printing press? The answer is both! Yes, you can print money legally, and the way you do that is simple – CREATE SOMETHING. When someone builds an object, say a house, or a mandolin, does the contractor or the artist not have the money he or she was paid? And does not the object itself also carry the value of its worth? Wealth has effectively DOUBLED in this example. This is what is known as growth. And your community is either growing, or it is shrinking, depending on the activities of local residents.

Let’s take Cape Breton. A lot of people like to shop at Walmart, because of the convenience and the free parking, not to mention the SAVINGS (oh doesn’t that just make you feel GREAT?). They forego the challenge of parking downtown and supporting a local Cape Breton business, because of the parking meters (please, city council, stop punishing our downtown, for goodness sake!!!) and the higher price of the goods. But why are the prices higher downtown? Because the local merchant – let’s call him Jack – doesn’t have the purchasing power that Wal-Mart does, plain and simple. But is there a hidden benefit to purchasing from Jack, and not the jack-asses who want to put him out of business?

Well let’s think about Jack for a moment. Jack, interestingly enough, owns the house down the road from you, the ramshackled one with shingles that need patching. He can’t afford to work on his house because, let’s be honest, his business has seen better days. Now, two scenarios here: 1) a small amount of your own money is saved but given to Wal-Mart, who essentially ships 90% of this off to its headquarters in Arkansas, to its Chinese workers, and to the billionaire Walton family. Hey, at least you saved a buck, right?

Technically yes. But what about Jack’s ramshackled old house that he can’t afford to fix up? His house makes your neighbourhood look pretty shoddy, not to mention all of the other Jacks who are having a tough time making it, with their equally shoddy properties. Their houses bring down the value of their neighbours’ houses, and so on down to your own, which isn’t worth very much because it’s just not all that desirable or pretty a place to live. What if, though, you and everyone else supported Jack’s local business, with its slightly higher prices (AND friendly service)? Suddenly, all of these Jacks have the money to replace shingles, paint their homes, and voila, YOUR neighbourhood becomes a more desirable place to live, and YOUR property value rises, and your dollar, believe it or not, has actually come full circle!! So that money was effectively better spent on Jack, even though it cost you 20% more. That 20% was the fat your community needed, to enrich YOUR life. Super skinny is so out of style my friends, and money truly IS like bloodflow – what you allow to recirculate, feeds you in turn. It’s not wishy-washy, or some lofty ideal like “karma”, it’s REALITY. Please think twice before saving your money the dummy way.

How badly do you have to dress to make THIS bike an uncool mode of transportation? Being frugal offers hundreds of opportunities to increase your personal style.

Let’s consider how to save it intelligently now!

1) Own your home.

Stop paying rent to the landlord, big dummy! That’s YOUR money! YOU worked hard for it. Sure, it looks expensive now, getting the home you want in already fixed-up condition and nice location, but think about the “now” of 30 years from now. As mentioned before, your monthly home expense is nearly frozen, while that of others keeps on rising. You “locked in” 30 years ago, and now you’re reaping some serious benefits. Benefits which mean more money in your pocket.

2) Buy used.

New cars typically lose up to 20% of their value the moment they leave the lot. New clothes are usually marked up between 200% and 300% of what it cost to make them. Buying used just makes more sense, and there’s a glut of things on the used market. I once got a $200 stainless kitchen sink at a yardsale, for $2!! How about a pair of jeans for $10 at Gala or Value Village? Even Winners will get you a third off regular price. Versus $80+ new at the store? Depending on your wage, for every hour you work, you may be bringing home (after taxes, EI, CPP, AND necessary living expenses) as little as $3-5 per hour on a $20 pay. Of course if you’re making more money than most, this will be higher, but for the average person, they will be astonished at how little money they actually clear IF they take the time to do the math. Check YOUR pay after expenses, and then see if it’s really worth 12 hours of your time for a new pair of jeans!

Cast iron cookware is NATURALLY NON-STICK. Once you season it (bake with a light coating of oil), it’s literally good for EVER

3) Stop being a “consumer”, buy quality that lasts!

Buying four cheapo $30 blenders over your life is stupid and wasteful, when you can buy one that will last for $60. I really get bugged by the cookware aisle at the stores, which sell $18 frying pans that will be in the trash a year after they are purchased, when my cast-iron pots and pans were handed down from my GRANDPARENTS. The funny thing is, they’re selling these flat-top, digital, glass cook ranges now which are incompatible with real cookware, and they’re selling them at a premium. “Style” choices like this incur other useless expenses like disposable frying pans, and people are paying a premium simply because “it’s easier to clean the range”. MTV has something to say to this kind of person: “You got Punked!” People really do abuse their money. Our cook range is from 1967, bought second hand for $50, and I’ve never had to buy a “special” frying pan. Buy things that make sense, which last, and which don’t take advantage of “the current trend”, a phrase which is really just another word for “stupid money, come this way!”

4) Do the hard work.

You have to be involved in your personal financial situation. You have to keep an eye out for your flock of fluffy, innocent dollars which hungry wolves are itching to take from you. Vigilance is EVERYTHING. Do you even know how much interest you are paying on your credit card? Did you know that a home equity line of credit can finance your debt as low as 3.5% interest? That’s HALF the interest of a regular line of credit, and it equals $$$AVINGS. Stop shipping your fluffy cute sheep soldiers off to Toronto in the form of wasteful interest! Do the research. Ask people you know. Become financially literate, and stop treating money as a taboo! Is the thing that everyone earns, which pays everyone’s rent each month, which buys everyone food, the thing that indirectly clothes you, really a subject that should be spoken of in hushed tones? GET REAL. You don’t have to be showy about it. TALK about your finances and you’ll know what not to do, as others will chime in with their real life stories and tips. SHARE information with friends. Let’s start breaking down the walls of ignorance, which only profit the big banks and faceless multinationals who have NO interest in your wellbeing (in fact some LOVE it when you’re not going so well, but that’s another topic altogether!).

5) Stick to a budget.

This is the time to be reasonable: the number one reason people abandon their latest effort at a budget is because they get too optimistic, too aggressive, and forget reality. You need something which is livable, and which is easy to track. We use a simple sheet of paper in the hall which tracks our expenses in six categories: Food, Entertainment, Transportation, Clothing/Gifts, Other, and Home/Vacation. Every time we come home with a receipt, the total is entered under the category and subtracted from the running total. Every Sunday morning new money is added to the category. Categories can be borrowed from, with the exception of Home/Vacation – Leisure time will be SACRED to you when you live on a budget, don’t squander it on a silly shirt you’ll soon forget you have anyway.

The reason Home and Vacation are in the same category is that, in my case, I need a reason to STOP investing in the house and take a break, and the idea of taking money away from vacations hurts! So this was my solution. You may have similar things you need to balance, and you can make your budget accordingly. Let it evolve over time! There is no hard and fast formula. It is about what will work, getting you off the money binge most people call their weekly expenses. A budget forces you to make trade-offs, and in the meantime, your savings/debt-repayment is sped up significantly. Find out how much you need to live, how much you need for weekly leisure, write it down, and follow the budget. If you’re always wanting to give up on it, you’re being too aggressive. If you’re following it and still going into debt, you’re not aggressive enough or you need to find a better job. But don’t stick your head in the sand, THIS is your periscope. Repeat after me, “In the budget, we trust.”

6) Track your finances.

I have tried various solutions, but by far the best is Mint.com. The site is run by Intuit, the company who created Quicken and who also might file your taxes with each year (we do). You should have no fear of identity theft if your computer is kept up to date and is virus-free. Modern security features on websites are so secure, calculations have shown it would take well over 30 gigawatts of computing power (1/100 of world energy consumption) and over a year to break a single 128-bit encrypted session in your web browser. If your computer is up to date and free of malware and viruses, you can be sure your bank information is unviewable. Let it go, this is important! What Mint does is links all of your bank accounts and all of your card transactions, automatically, and builds them into one cohesive financial picture. You can see where your money is going, how things are progressing, and all of this without any effort on your part to update accounts – this is done automatically each day and each time you sign-in. You will have to work on categorizing transactions, which it is not perfect at, however the program has a feature to remember how you categorized X or Y transaction, and so future transactions are then automatically put under the proper headings.

Oh yeah, I forgot, it is absolutely free!

(If you want to pay $100 for Intuit’s Quicken software, which doesn’t require the Internet, it works similarly to Mint, however you can be guaranteed that modern servers are more secure than your home computer – your choice!)

7) Be well.

I can’t stress enough, that you are your wellbeing, and no amount of money can save you if you lose your health, nor is any amount of savings worth physical or mental difficulty. Eat well, exercise, and laugh a lot. It doesn’t take a fortune to be healthy, and in many cases it can save you money. What you save on gas in riding your bike, you can put towards a fancy home-cooked, home-canned batch of spicy organic chicken soup. There is no reason why you can’t live happily on a budget. Better than everything, when you retire one day with your healthy, happy, financially free body and mind, the world will be your oyster, and there’ll be no stopping the good things you’ll get up to. Financially, FREE.

A neighbour up the road was GIVING away all of this shale, to the first couple he saw determinedly sifting through the fields behind his house. I’ll admit, we got lucky, but we wouldn’t have if we’d just run to the garden centre with our credit cards!

The other Frugal Friday posts on this blog:

Kennington Cove is one of the darlings of the Cape Breton beaches. It’s sandy, wide, and set in a National Historic Site of Canada, so that the woods all around it are still intact, and there are no houses. Kennington Cove deserves its reputation as one of the best beaches on the island, as I found out when I went there last week with my friend Stacy.

Kennington Cove is one of the darlings of the Cape Breton beaches. It’s sandy, wide, and set in a National Historic Site of Canada, so that the woods all around it are still intact, and there are no houses. Kennington Cove deserves its reputation as one of the best beaches on the island, as I found out when I went there last week with my friend Stacy. This is a tiger lily outside of Stacy’s house. I am absolutely in love with tiger lilies. They are so summery, so alive and bright!

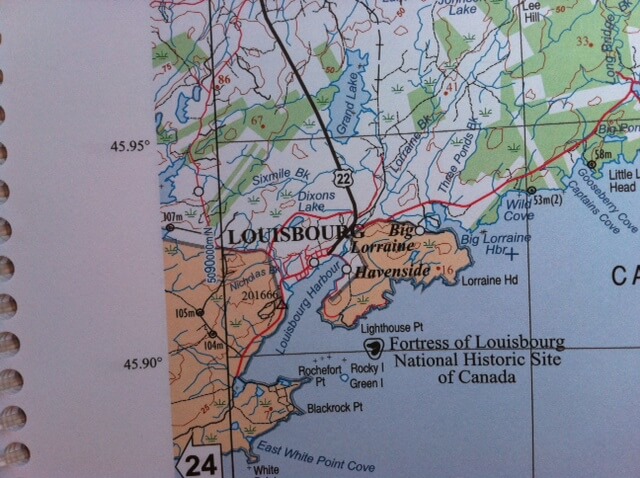

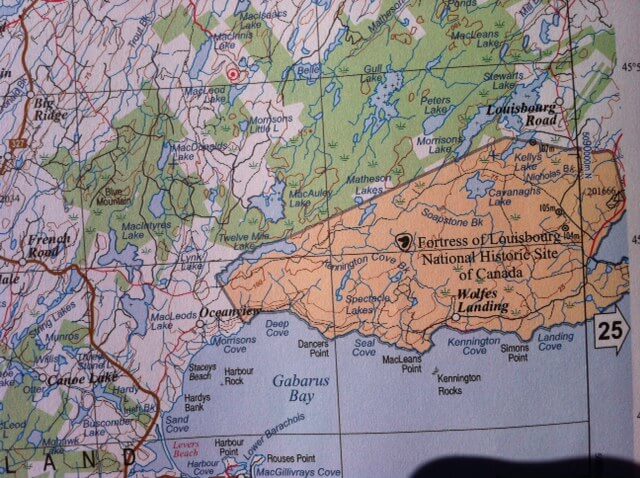

This is a tiger lily outside of Stacy’s house. I am absolutely in love with tiger lilies. They are so summery, so alive and bright! It was hot and sunny as we drove through Louisbourg, and then out towards the fortress. (It’s only small in this picture – can you see it?)

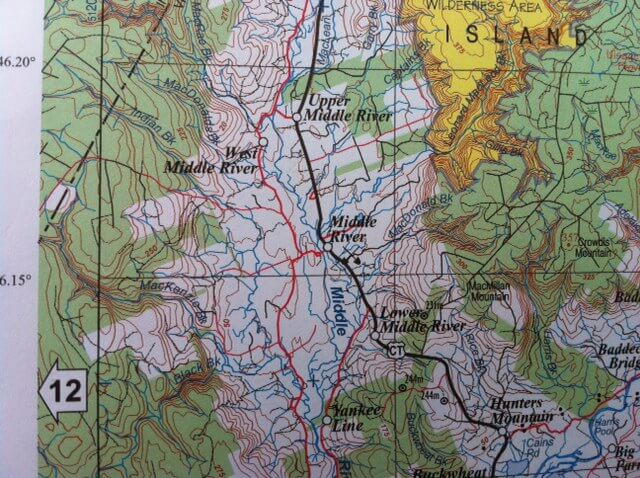

It was hot and sunny as we drove through Louisbourg, and then out towards the fortress. (It’s only small in this picture – can you see it?) As usual, I had my Nova Scotia atlas along.

As usual, I had my Nova Scotia atlas along.

A few weeks ago I got myself a couple of the “Think Cape Breton First” signs that the Cape Breton County Economic Development Authority makes and sells. (Pretty good deal – two signs for $40!). I’ll be taking pictures of the signs as I take them with me on my travels around the island.

A few weeks ago I got myself a couple of the “Think Cape Breton First” signs that the Cape Breton County Economic Development Authority makes and sells. (Pretty good deal – two signs for $40!). I’ll be taking pictures of the signs as I take them with me on my travels around the island.

(I had warned Stacy before we set out: “I stop to take pictures, a lot. I hope it doesn’t annoy you.”)

(I had warned Stacy before we set out: “I stop to take pictures, a lot. I hope it doesn’t annoy you.”)

Then we went out to Lighthouse Point to check it out. I had no idea it existed! I had assumed I knew the lay of the land around Louisbourg, and it turned out there was a section I knew nothing about! Fancy that… Cape Breton really is a big island, with so many interesting coastlines and hills, that it could take your whole life, just exploring it.

Then we went out to Lighthouse Point to check it out. I had no idea it existed! I had assumed I knew the lay of the land around Louisbourg, and it turned out there was a section I knew nothing about! Fancy that… Cape Breton really is a big island, with so many interesting coastlines and hills, that it could take your whole life, just exploring it.